Energy transition worldwide: why price swings persist even as renewables scale

The global shift toward sustainable energy sources is accelerating, but despite the rapid growth of renewables, price volatility in energy markets remains a significant challenge. Understanding the underlying factors driving these fluctuations is essential for policymakers, investors, and consumers navigating the energy transition worldwide.

Renewables’ Growing Share and Market Impact

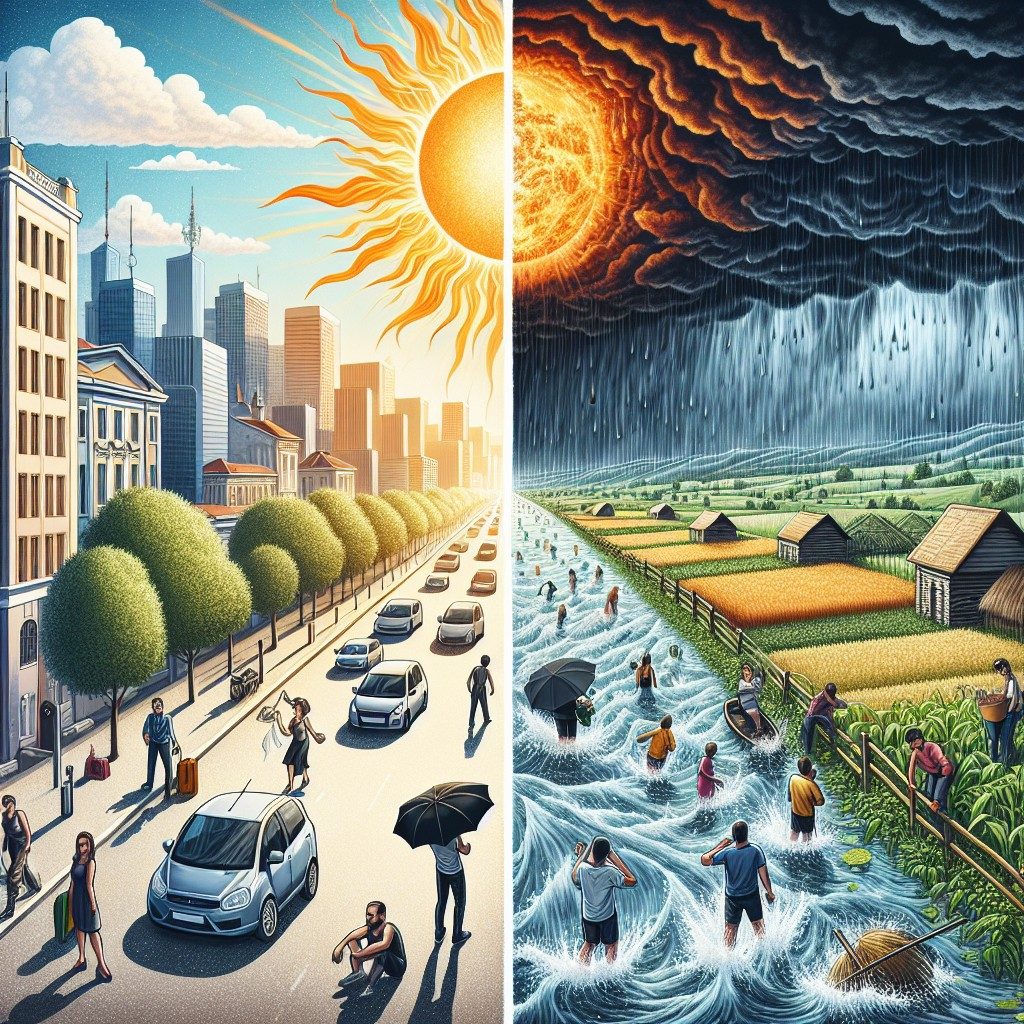

Renewable energy, including solar, wind, and hydropower, has seen unprecedented expansion over the past decade. According to recent data from the International Energy Agency (IEA), renewables accounted for nearly 30% of global electricity generation in 2023. This surge is a critical component of the ongoing energy transition, aiming to reduce dependence on fossil fuels and lower carbon emissions. However, the intermittent nature of renewable sources means that their supply can vary significantly based on weather conditions, contributing to price swings in energy markets.

Supply and Demand Imbalances

Despite increased renewable capacity, many regions still rely heavily on fossil fuels for baseline power generation. Variability in renewable output often results in sudden gaps that must be filled by gas, coal, or nuclear plants, leading to sharp price fluctuations. For instance, low wind speeds or reduced sunlight during peak demand hours can trigger a rise in spot prices as utilities scramble for alternative power sources. Additionally, geopolitical tensions and supply chain disruptions have occasionally reduced fossil fuel availability, compounding price volatility even as the energy transition progresses.

Grid Infrastructure and Storage Limitations

The integration of renewables into existing power grids poses technical and logistical challenges that influence price stability. Many grids lack sufficient transmission capacity to balance supply across regions, causing localized shortages or surpluses with corresponding price effects. Moreover, energy storage technologies, such as batteries and pumped hydro, while expanding, have not yet reached a scale adequate to fully offset renewable intermittency. Without robust storage solutions, excess renewable generation during off-peak periods cannot be efficiently stored for use during high demand, perpetuating price swings.

Policy and Regulatory Factors

Government policies also shape the dynamics of price volatility during the energy transition. Subsidies, carbon pricing, and renewable mandates influence investment decisions and operational strategies of energy producers. However, inconsistent or rapidly changing policies can introduce uncertainty, discouraging long-term investments in infrastructure and storage needed to stabilize prices. In some cases, regulatory frameworks have yet to adapt effectively to the complexities introduced by distributed and variable renewable generation, further contributing to erratic energy costs.

Global Events and Economic Influences

External factors such as economic growth, commodity price fluctuations, and geopolitical incidents continue to play a critical role in energy price behavior. For example, the recent surge in natural gas prices caused by supply constraints in major exporting countries has reverberated across markets, impacting electricity prices despite renewable generation increases. Economic recovery trends post-pandemic have also altered consumption patterns unpredictably, occasionally outpacing renewable supply increments and triggering short-term price escalations.

Conclusion

In conclusion, while the global energy transition is steadily advancing with expanding renewable energy capacity, persistent price swings reflect a complex interplay of supply-demand imbalances, infrastructure limitations, policy landscapes, and external economic factors. Addressing these challenges will require sustained investment in grid modernization, energy storage technologies, and coherent regulatory frameworks. Observers anticipate that as these supporting systems mature, price volatility linked to renewable integration will gradually diminish, facilitating a more stable and sustainable energy future.

Frequently Asked Questions about energy transition

What causes price swings during the energy transition?

Price swings during the energy transition are mainly caused by the intermittent nature of renewable energy supply, insufficient storage capacity, grid constraints, and fluctuations in fossil fuel markets that are still needed to balance demand.

How does renewable energy impact energy prices?

Renewable energy can lower long-term energy prices by reducing reliance on expensive fossil fuels, but its variability and current infrastructure challenges can also lead to short-term price fluctuations.

Why is energy storage important in the energy transition?

Energy storage is crucial because it helps balance supply and demand by storing excess renewable energy generated during low-demand periods for use when production is low, thus reducing price volatility.

Can policy changes affect energy price stability?

Yes, consistent and supportive policies encourage investments in renewable technologies and infrastructure, which can enhance energy price stability during the energy transition.

Will price swings continue as renewables grow?

Price swings may persist in the short term due to technical and market challenges, but with improvements in grid infrastructure and storage, their frequency and severity are expected to decrease over time as the energy transition progresses.